Industrial Investment

Industrial real estate has moved far beyond traditional warehousing. The rise of e-commerce, supply chain reconfiguration, and on-demand logistics has reshaped the sector into one of the most dynamic and competitive asset classes. For investors and developers, opportunity lies not just in space but in strategy.

At Steelhead Real Estate Partners, we help clients identify, acquire, and optimize industrial assets that align with emerging logistics trends, demographic shifts, and infrastructure expansion. Whether it’s last-mile delivery, manufacturing repositioning, or adaptive reuse, our expertise translates industrial complexity into investment clarity.

Market Intelligence that Anticipates Change

The most successful industrial strategies are built on foresight. Steelhead Real Estate Partners combines advanced data modeling with deep regional understanding to pinpoint where growth, demand, and connectivity converge.

From transportation corridors and labor availability to zoning, power access, and proximity to end users, we evaluate every factor shaping industrial performance. Our team, based in Marin County and serving the Bay Area and Western U.S., delivers insight that informs both immediate acquisition and long-term asset positioning.

We do not just follow market trends we interpret them, revealing where evolving logistics networks and regional growth patterns create opportunity ahead of the curve.

From Acquisition to Optimization: Strategy in Motion

Industrial assets succeed through disciplined execution understanding not only how a property performs today, but how it will adapt tomorrow. At Steelhead, we manage the entire lifecycle with precision and purpose.

We begin by analysing fundamentals: site configuration, utility capacity, lease structures, tenant credit, and entitlement flexibility. This foundation informs strategic acquisition and capital deployment. Once under ownership, we focus on asset optimization refining layouts, upgrading infrastructure, and enhancing operational efficiency to meet modern logistics and tenant needs.

When repositioning is required, we guide adaptive reuse strategies that transform outdated facilities into competitive, high-demand assets. As performance matures, we structure and time dispositions to capture full market value, ensuring investors benefit from both cyclical timing and long-term fundamentals.

At every stage, our process blends analytics, market intuition, and collaborative execution aligning vision and performance with precision.

Institutional Discipline, Boutique Focus

Steelhead Real Estate Partners brings together institutional-level rigor and boutique-level focus a combination that ensures clarity, accountability, and performance throughout every engagement.

We provide the detailed underwriting, capital structuring, and market positioning that institutional investors expect, with the agility and responsiveness of a dedicated advisory partner. Whether you are pursuing a single asset or assembling a regional portfolio, we tailor each strategy to your objectives, translating market opportunity into measurable outcomes.

Why Steelhead Real Estate Partners

Industrial real estate is evolving at a pace unmatched by any other asset class and success requires alignment between market dynamics, capital intent, and operational strategy. Steelhead Real Estate Partners operates precisely at that intersection.

We don’t speculate on trends we engineer results. Our mission is to help clients capitalize on industrial evolution through disciplined insight, data-backed execution, and unwavering partnership.

Ready to Advance Your Industrial Strategy?

Whether you’re acquiring, repositioning, or optimizing industrial assets, Steelhead Real Estate Partners stands ready to guide your next move.

Let’s start a strategic conversation that transforms logistics and land into long-term value.

Industrial Deals and Projects

Illuminations Distribution Facility

Illuminations Distribution Facility, Louisville, KY. Approximately 450,000 sf. Acquisition, entitlement, construction, leasing and capital markets.

Steelhead Corporate Center

Steelhead Corporate Center, Petaluma, CA. Office/warehouse facility. Approximately 40,000 sf. Acquisition, entitlement and sale.

Sears & Roebuck Co

Sears & Roebuck Co., Over a 20 year period involved in the programmatic disposition and acquisition of over approximately 1,000,000 sf of distribution and retail facilities throughout the West.

The North Face Inc.

The North Face Inc. National store expansion program, multiple distribution facilities and HQ relocation, totaling approximately 500,000 sf throughout the US.

Converse Shoes

Converse Shoes National Distribution Center, Southern CA. 600,000 sf lease.

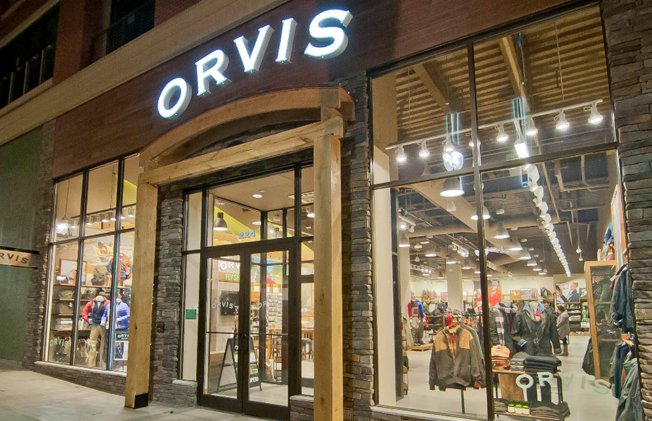

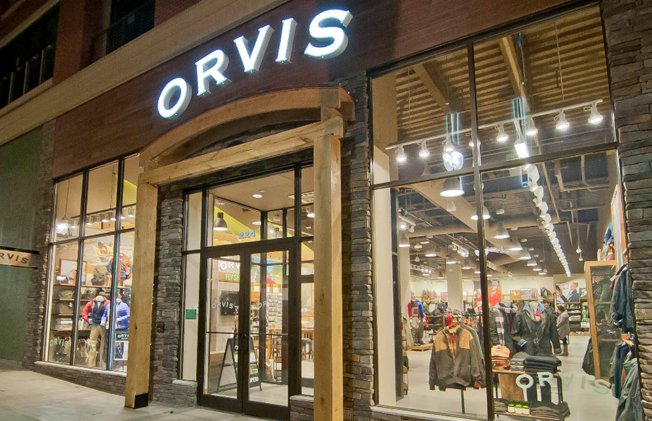

The Orvis Company.

The Orvis Company. Coordinated a retail expansion program of approximately 10 locations throughout the Western United States.

Miller Brewing Company

Miller Brewing Company distribution Center, Hayward, CA. Approx. 250,000 sf lease.

Nestle Beverage Company

Nestle Beverage Company distribution center, Oakland CA. Approx. 132,000 sf lease.

Costco Stores

Costco Stores. Coordinated the expansion of Costcos retail expansion strategy in target markets throughout Northern California.

FAQ

We advise on logistics facilities, last-mile delivery centers, light manufacturing, flex spaces, and industrial redevelopment opportunities.

By combining data-driven logistics analysis, infrastructure mapping, and regional growth tracking to uncover assets positioned for sustainable demand.

Yes. We specialize in adaptive reuse strategies that modernize older assets through infrastructure upgrades, layout redesign, and tenant realignment.

We focus on improving space utilization, reducing costs, and integrating sustainability measures to enhance efficiency and long-term tenant retention.

Our balance of institutional discipline and boutique agility ensures precision in analysis and flexibility in execution from underwriting to disposition.

Developers, private investors, and institutional owners pursuing logistics, light industrial, or adaptive reuse strategies across the Bay Area and Western U.S.

We’re headquartered in San Anselmo / Marin County and provide advisory services throughout the SF Bay Area , Stockton , Modesto , Tracy and Western U.S. markets.